Irs Schedule C 2024 Gross Receipts – For more tax tips, check out our tax filing cheat sheet and the top tax software for 2024 receipts.” 4. You claim too many business expenses or losses You’re required to file a Schedule C . Americans who fail to make on-time and accurate estimated quarterly tax payments could be hit with a surprise bill after the IRS penalty jumped to 8%. .

Irs Schedule C 2024 Gross Receipts

Source : www.reddit.com2023 Instructions for Schedule C

Source : www.irs.govForm 1099 K: Definition, Uses, Who Must File

Source : www.investopedia.com2018 2024 Form IRS 1040 Schedule C EZ Fill Online, Printable

Source : irs-schedule-c-ez.pdffiller.comBusiness Tax Renewal Instructions | Los Angeles Office of Finance

Source : finance.lacity.govSchedule c expenses worksheet: Fill out & sign online | DocHub

Source : www.dochub.comWhat is an IRS Schedule C Form?

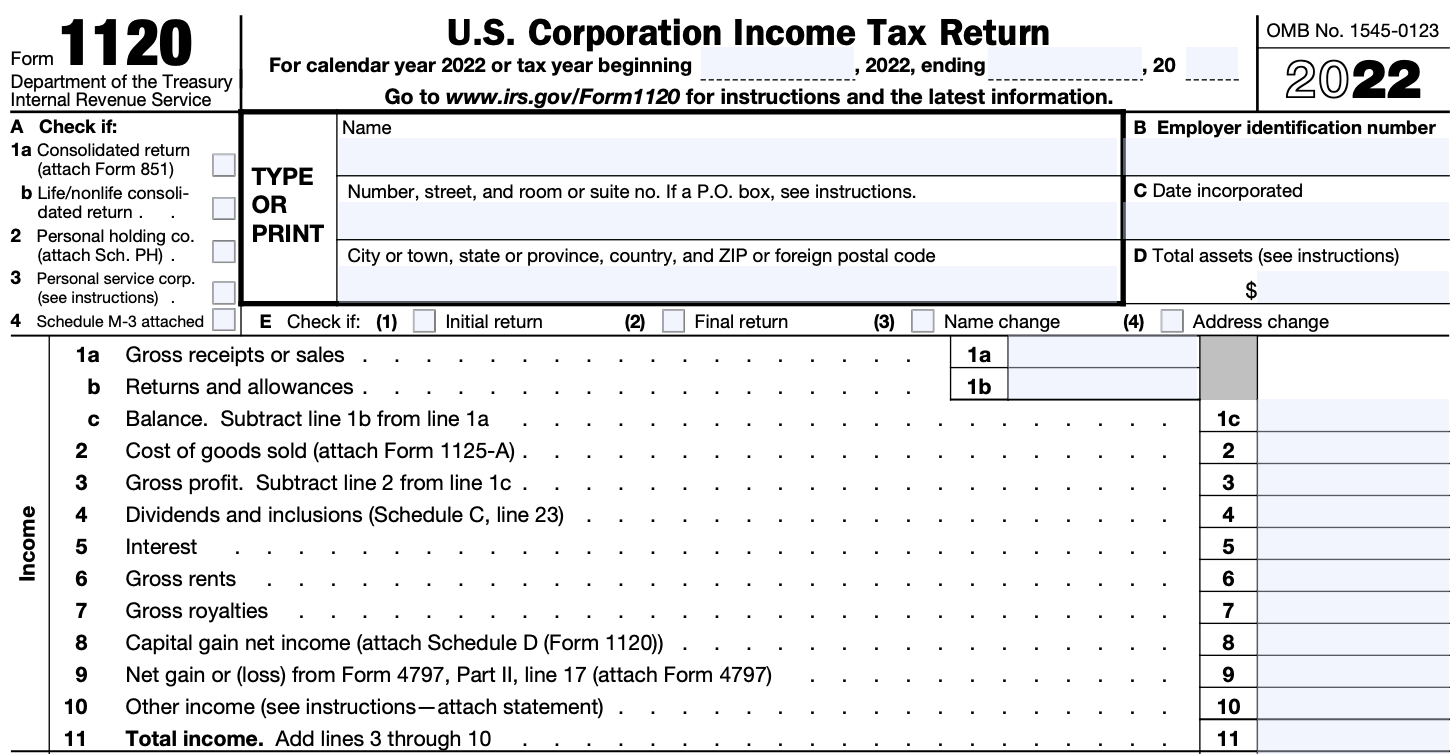

Source : falconexpenses.comIRS Form 1120

Source : kruzeconsulting.comSchedule C Instructions: How to Fill Out Form 1040 Excel Capital

Source : www.excelcapmanagement.comAlabama NATP | Birmingham AL

Source : m.facebook.comIrs Schedule C 2024 Gross Receipts RFE I 485 / I 865: Sponsor doesn’t meet requirements? : r/USCIS: Taxpayers could have started filing their taxes for the 2023 tax year on Jan. 29.. You can use the schedule chart below to estimate when you can expect to receive your refund based on when you . This part of the year brings a unique focus for those keeping an eye on their taxes, often juggling dual objectives. You might find yourself preoccupied with readying and submitting your 2023 tax .

]]>

:max_bytes(150000):strip_icc()/ScreenShot2022-01-24at10.05.23AM-cf89715f09964cbca096821b63196735.png)